Gordon Growth Formula: A Simple Guide to Valuation

Understanding the Gordon Growth Model is essential for anyone looking to evaluate the intrinsic value of a stock. This valuation method, also known as the Dividend Discount Model (DDM), assumes a company’s dividends will grow at a constant rate indefinitely. Whether you’re an investor, financial analyst, or student, mastering this formula can provide valuable insights into stock valuation. Below, we’ll break down the Gordon Growth Model step by step, explore its applications, and address common questions to help you use it effectively. (stock valuation,dividend discount model,investment analysis)

What is the Gordon Growth Model?

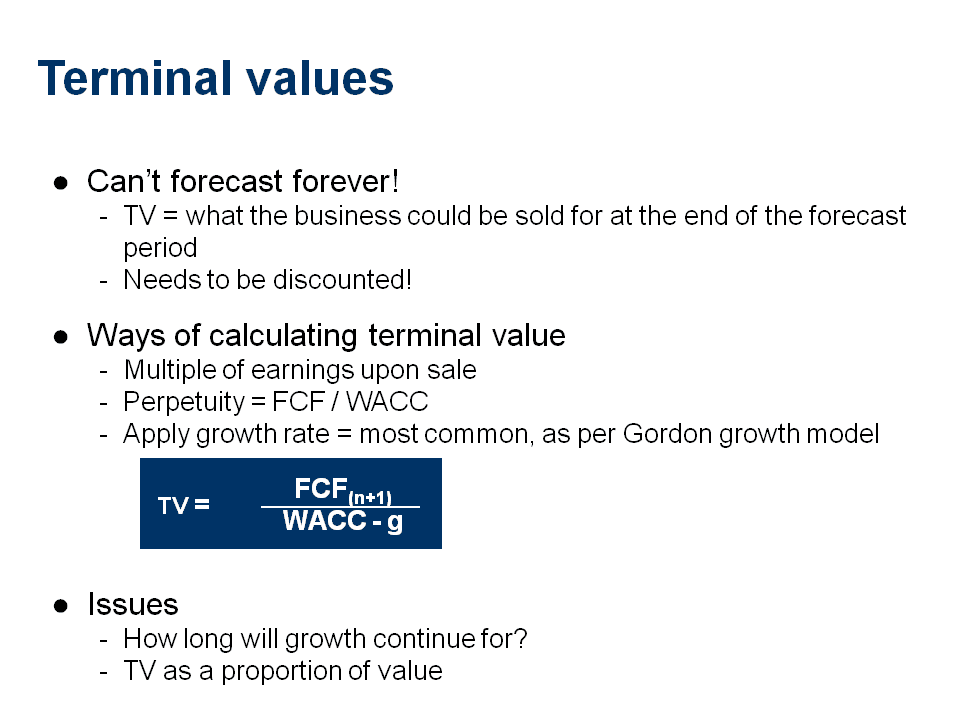

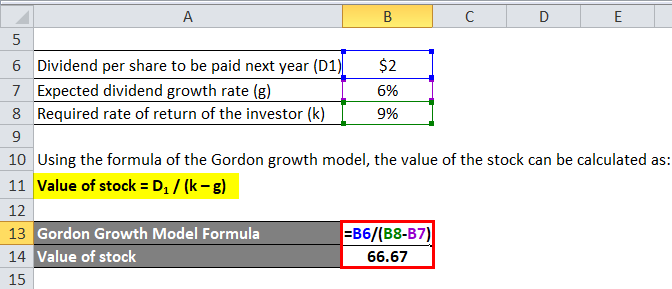

The Gordon Growth Model is a financial tool used to calculate the present value of a stock based on its future dividend payments. It’s particularly useful for companies with stable and predictable dividend growth rates. The formula is:

Stock Price = (D1) / (r - g)

Where:

- D1 = Expected dividend per share next year

- r = Required rate of return for the investor

- g = Constant growth rate of dividends

This model is ideal for mature companies with consistent dividend policies. (dividend growth,stock pricing,financial modeling)

How to Apply the Gordon Growth Model

Step 1: Gather the Required Data

To use the formula, you’ll need:

- The current dividend per share (D0)

- The expected dividend growth rate (g)

- The required rate of return ®

📌 Note: Ensure the growth rate (g) is less than the required rate of return ® for the model to work.

Step 2: Calculate the Next Year’s Dividend (D1)

Use the formula: D1 = D0 × (1 + g).

Step 3: Plug Values into the Gordon Growth Formula

Insert D1, r, and g into the formula to find the stock’s intrinsic value.

Step 4: Compare with Market Price

If the calculated value is higher than the current market price, the stock may be undervalued. (intrinsic value,stock analysis,valuation methods)

Limitations of the Gordon Growth Model

While the Gordon Growth Model is useful, it has limitations:

- Assumes constant dividend growth, which may not reflect reality.

- Not suitable for non-dividend-paying companies.

- Sensitive to changes in growth rate and required return.

Always use this model alongside other valuation techniques for a comprehensive analysis. (financial limitations,valuation tools,investment strategies)

Gordon Growth Model vs. Other Valuation Methods

| Method | Best For | Key Difference |

|---|---|---|

| Gordon Growth Model | Mature, dividend-paying companies | Assumes constant dividend growth |

| Discounted Cash Flow (DCF) | Companies with unpredictable cash flows | Uses free cash flows instead of dividends |

| Price-to-Earnings (P/E) Ratio | Quick comparisons | Doesn’t consider future growth |

Choose the method that best fits your investment goals. (valuation comparison,DCF model,P/E ratio)

The Gordon Growth Model is a powerful tool for valuing dividend-paying stocks, especially those with stable growth rates. By understanding its components and limitations, you can make more informed investment decisions. Remember to gather accurate data, compare results with market prices, and use complementary valuation methods for a well-rounded analysis. (stock valuation,dividend discount model,investment analysis)

What is the Gordon Growth Model used for?

+

The Gordon Growth Model is used to calculate the intrinsic value of a stock based on its future dividend payments and a constant growth rate.

Can the Gordon Growth Model be used for non-dividend-paying stocks?

+

No, the model is only applicable to companies that pay dividends, as it relies on dividend payments for valuation.

What happens if the growth rate (g) is greater than the required return ®?

+

If g > r, the formula will yield a negative or unrealistic result, making it unusable. The growth rate must always be less than the required return.