Understanding Your W2: A Quick Sample Guide

<!DOCTYPE html>

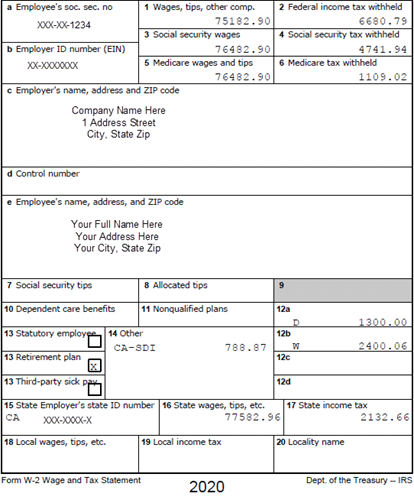

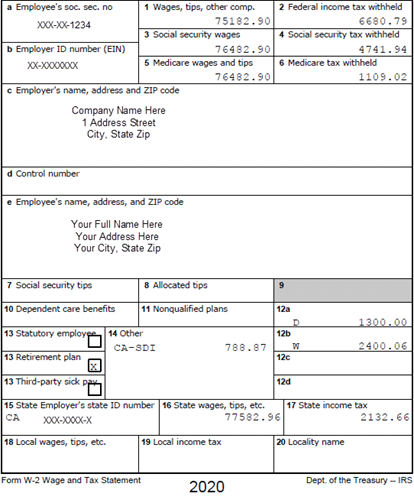

Tax season can be overwhelming, but understanding your W2 form is a crucial step in filing your taxes accurately. This guide breaks down the key components of a W2, helping you decipher the information and use it effectively for your tax return. Whether you're a first-time filer or a seasoned taxpayer, this quick sample guide will simplify the process, ensuring you're well-prepared for tax season.

What is a W2 Form?

A W2 form, officially known as the Wage and Tax Statement, is a document provided by your employer that summarizes your annual wages and the taxes withheld from your paycheck. It’s essential for filing your federal and state income tax returns accurately. Understanding each section of the W2 ensures you report your income correctly and claim all eligible deductions.

Key Sections of Your W2

Your W2 is divided into several boxes, each containing specific information. Here’s a breakdown of the most important sections:

Box 1: Wages, Tips, and Other Compensation

This box shows your total taxable wages, tips, and other compensation for the year. It’s the primary figure used to calculate your taxable income.

Box 2: Federal Income Tax Withheld

This indicates the total amount of federal income tax withheld from your paycheck throughout the year. It’s crucial for determining whether you owe taxes or are eligible for a refund.

Box 3: Social Security Wages

This box displays your total earnings subject to Social Security tax. The current tax rate is 6.2% for employees, up to the annual wage base limit.

Box 4: Social Security Tax Withheld

This shows the total Social Security tax withheld from your earnings. Ensure this matches your calculations to avoid discrepancies.

Box 5: Medicare Wages and Tips

This box lists your total earnings subject to Medicare tax. The current tax rate is 1.45% for employees, with an additional 0.9% for high earners.

Box 6: Medicare Tax Withheld

This indicates the total Medicare tax withheld from your earnings. Verify this amount to ensure accuracy in your tax filings.

📌 Note: Always double-check the information on your W2 against your pay stubs to ensure accuracy.

How to Use Your W2 for Tax Filing

Once you understand your W2, you can use it to file your taxes efficiently. Here’s a step-by-step guide:

- Gather Your Documents: Collect your W2, 1099s, and other income-related forms.

- Choose Your Filing Method: Decide whether to file manually, use tax software, or hire a professional.

- Enter W2 Information: Input the data from your W2 into your tax return form or software.

- Review and Submit: Double-check all entries for accuracy before submitting your tax return.

Common W2 Mistakes to Avoid

Errors on your W2 can lead to delays in your tax refund or penalties. Watch out for these common mistakes:

- Incorrect Personal Information: Ensure your name, address, and Social Security number are accurate.

- Mismatched Earnings: Verify that the wages reported match your pay stubs.

- Missing or Incorrect Withholdings: Check that all taxes withheld are correctly reported.

📌 Note: If you find an error on your W2, contact your employer immediately to request a corrected form.

W2 Checklist for Tax Preparation

Use this checklist to ensure you’re fully prepared to use your W2 for tax filing:

- ✔️ Receive your W2 from your employer by January 31st.

- ✔️ Verify all personal and financial information for accuracy.

- ✔️ Compare Box 1 with your total earnings from pay stubs.

- ✔️ Ensure all taxes withheld (Boxes 2, 4, and 6) are correct.

- ✔️ Use the information to complete your tax return accurately.

By understanding your W2 and following this guide, you’ll be well-equipped to navigate tax season with confidence. Remember, accuracy is key to a smooth tax filing process. W2 form, tax filing, tax preparation, tax season.

What should I do if I haven’t received my W2 by February?

+Contact your employer to request a copy. If they fail to provide it, you can file Form 4852 with the IRS as a substitute.

Can I file my taxes without a W2?

+It’s not recommended, as your W2 contains essential income and tax information. Use Form 4852 if you cannot obtain your W2.

How do I correct a mistake on my W2?

+Notify your employer immediately. They should issue a corrected W2 (Form W-2c) and file it with the SSA and IRS.